Shopify has been treading water for the past six months, recording a small loss of 2.9% while holding steady at $111.98.

Does this present a buying opportunity for SHOP? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Are We Positive On Shopify?

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

1. TPV Surges as Payment Activity Increases

TPV, or total processing volume, is the aggregate dollar value of transactions flowing through Shopify’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more chances Shopify has to upsell additional services (like banking).

Shopify’s TPV punched in at $47.5 billion in Q1, and over the last four quarters, its year-on-year growth averaged 31.7%. This performance was fantastic and shows the company is capturing significant demand on its platform. It also indicates that customers are highly active and engaged, driving higher transaction volumes and allowing Shopify to collect more fees.

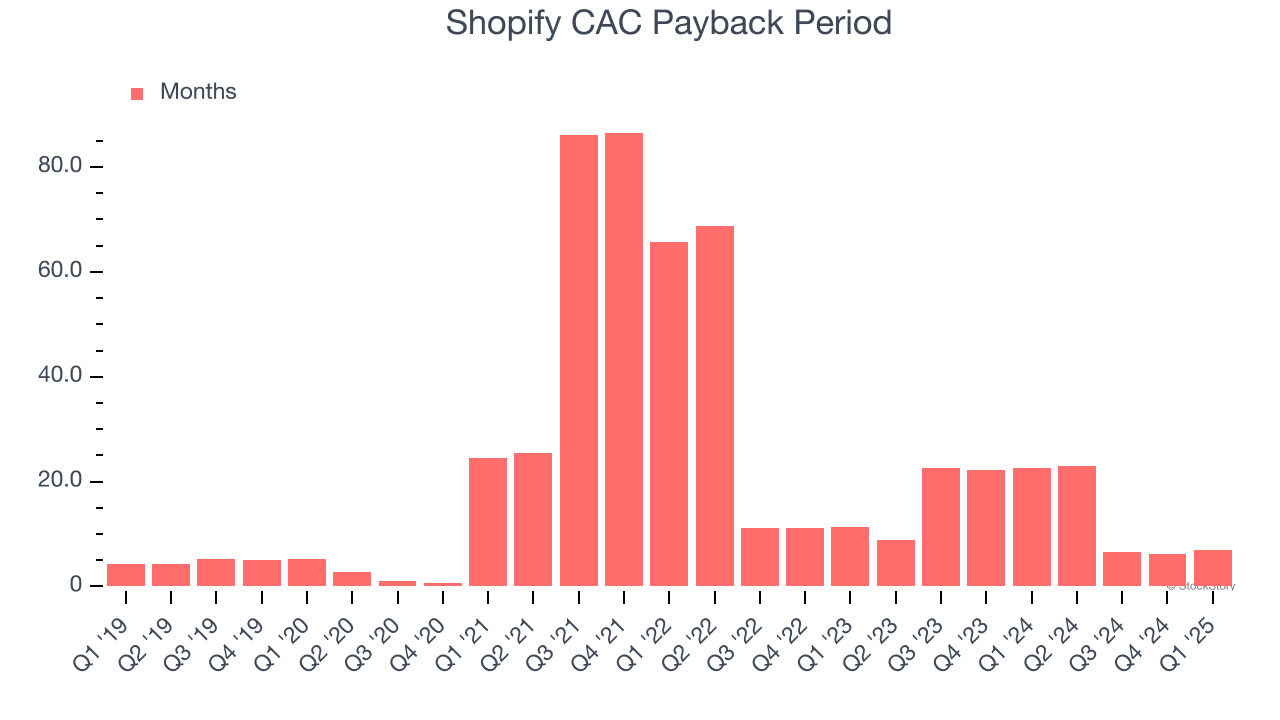

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Shopify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6.9 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Shopify more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

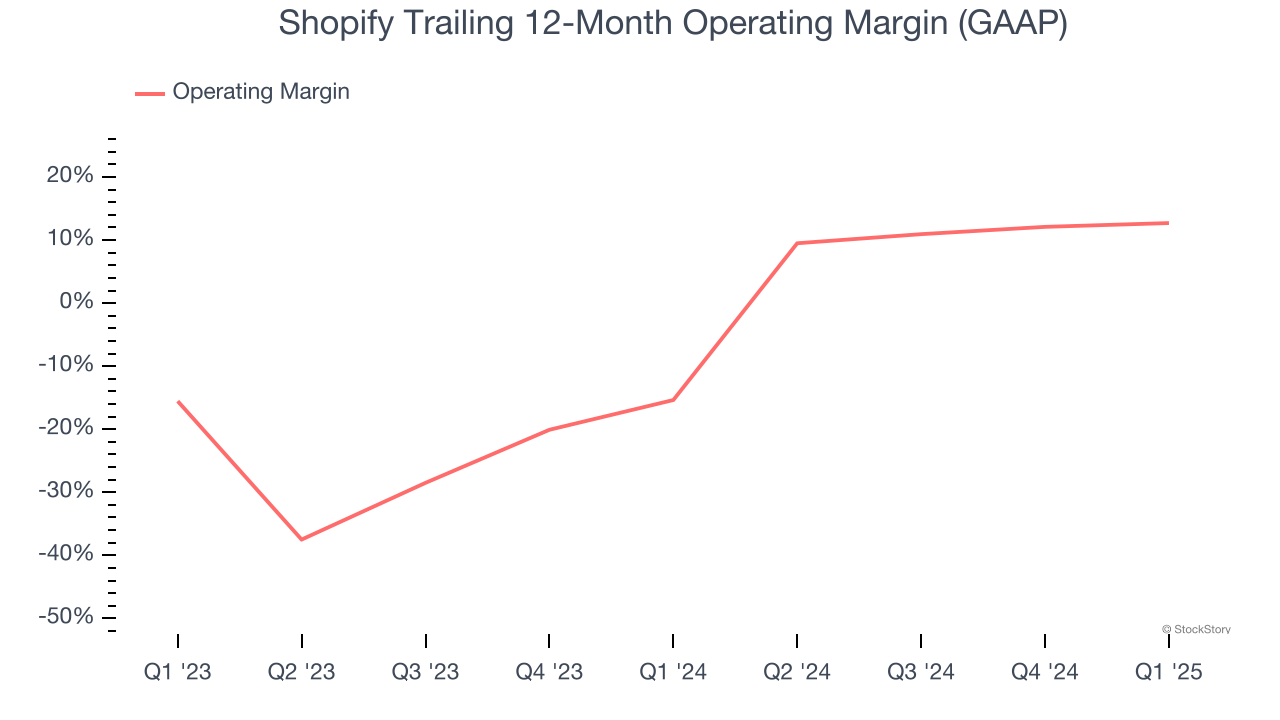

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Analyzing the trend in its profitability, Shopify’s operating margin rose by 28.1 percentage points over the last year, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 12.7%.

Final Judgment

These are just a few reasons why we think Shopify is a high-quality business, but at $111.98 per share (or 12.7× forward price-to-sales), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.