Over the past six months, Flowserve’s stock price fell to $48.87. Shareholders have lost 19.7% of their capital, disappointing when considering the S&P 500 was flat. This might have investors contemplating their next move.

Is now the time to buy Flowserve, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Flowserve Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why FLS doesn't excite us and a stock we'd rather own.

1. Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Gas and Liquid Handling companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Flowserve’s future revenue streams.

Flowserve’s backlog came in at $2.90 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 3.6%. This performance was underwhelming and suggests that increasing competition is causing challenges in winning new orders.

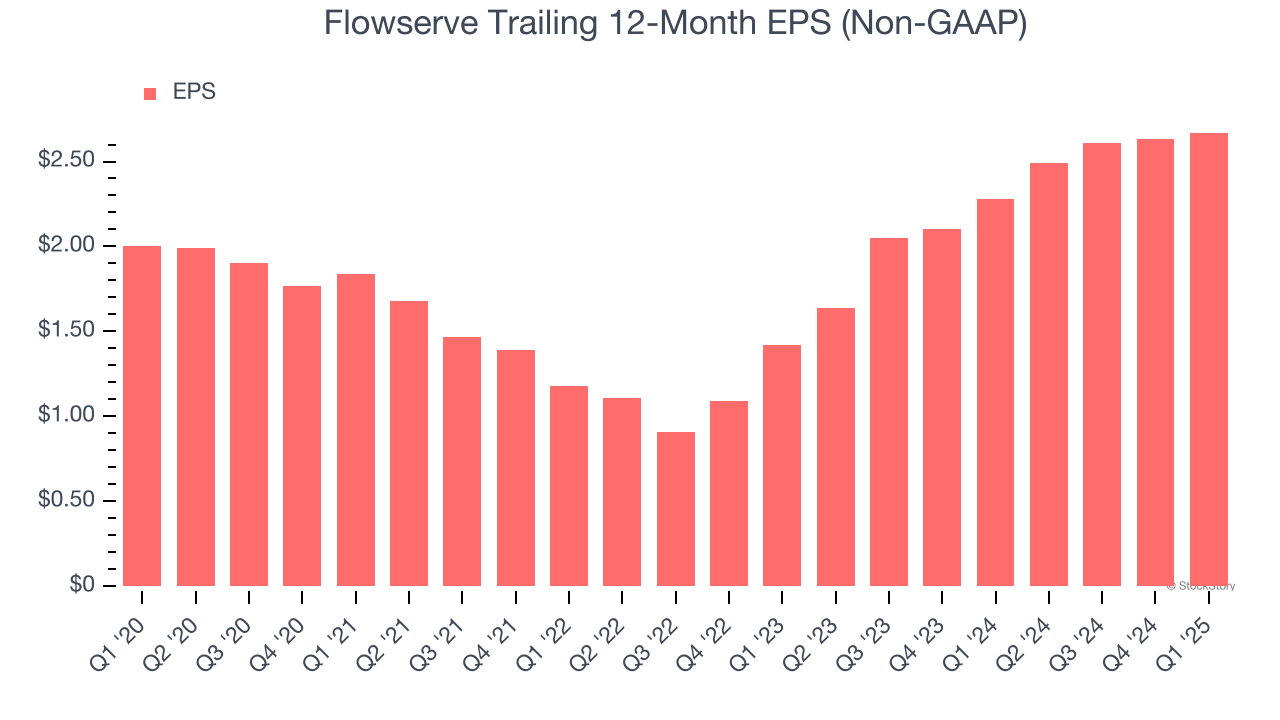

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Flowserve’s EPS grew at an unimpressive 5.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

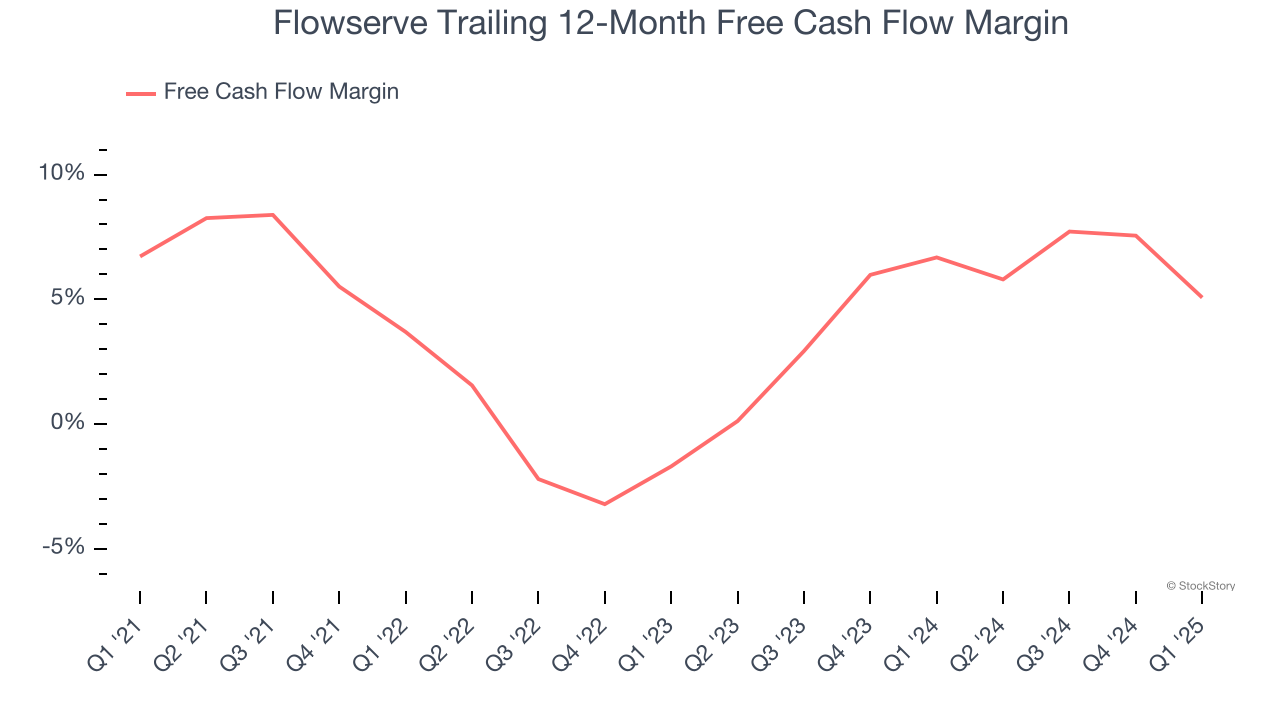

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Flowserve’s margin dropped by 1.7 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Flowserve’s free cash flow margin for the trailing 12 months was 5.1%.

Final Judgment

Flowserve isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 15.1× forward P/E (or $48.87 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.