Gaming metaverse operator Roblox (NYSE:RBLX) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 20.9% year on year to $1.08 billion. Next quarter’s revenue guidance of $1.14 billion underwhelmed, coming in 3.5% below analysts’ estimates. Its GAAP loss of $0.41 per share was 13.9% below analysts’ consensus estimates.

Is now the time to buy Roblox? Find out by accessing our full research report, it’s free.

Roblox (RBLX) Q2 CY2025 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.10 billion (20.9% year-on-year growth, 2% miss)

- EPS (GAAP): -$0.41 vs analyst expectations of -$0.36 (13.9% miss)

- Adjusted EBITDA: $18.36 million vs analyst estimates of $220.3 million (1.7% margin, 91.7% miss)

- The company lifted its revenue guidance for the full year to $4.44 billion at the midpoint from $4.33 billion, a 2.6% increase

- EBITDA guidance for the full year is $25 million at the midpoint, below analyst estimates of $1.20 billion

- Operating Margin: -29.8%, down from -26.6% in the same quarter last year

- Free Cash Flow Margin: 16.3%, down from 41.2% in the previous quarter

- Daily Active Users: 111.8 million, up 32.3 million year on year

- Market Capitalization: $84.74 billion

“Our Q2 2025 results demonstrate broad-based strength across the Roblox platform, fueled by the emergence of several viral experiences. Our year on year growth this quarter is a reflection of our strategic investments in infrastructure and performance, discovery, and the virtual economy, which continue to create fertile conditions for creators to thrive as part of a healthy, interconnected ecosystem. We are encouraged by the momentum across Roblox as we look to capture 10% of the global gaming content market flowing through our platform,” said David Baszucki, founder and CEO of Roblox.

Company Overview

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

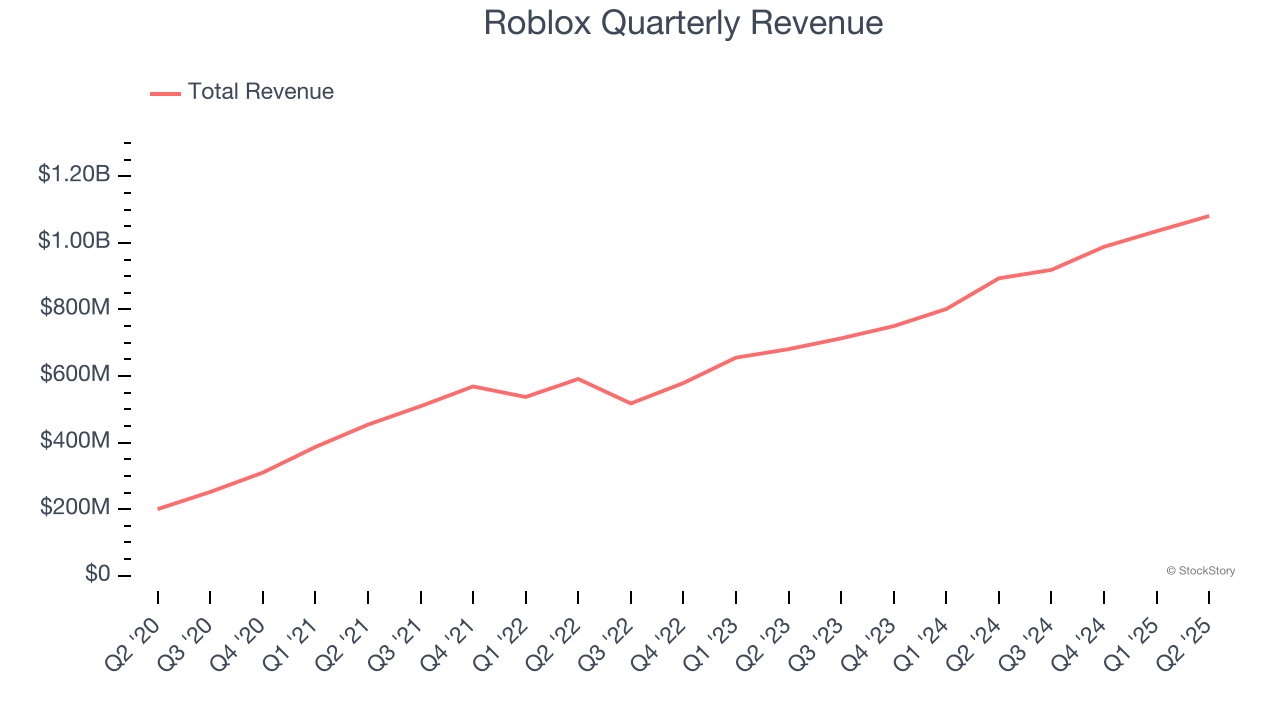

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Roblox grew its sales at an excellent 22.2% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Roblox generated an excellent 20.9% year-on-year revenue growth rate, but its $1.08 billion of revenue fell short of Wall Street’s high expectations. Company management is currently guiding for a 23.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 27.9% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

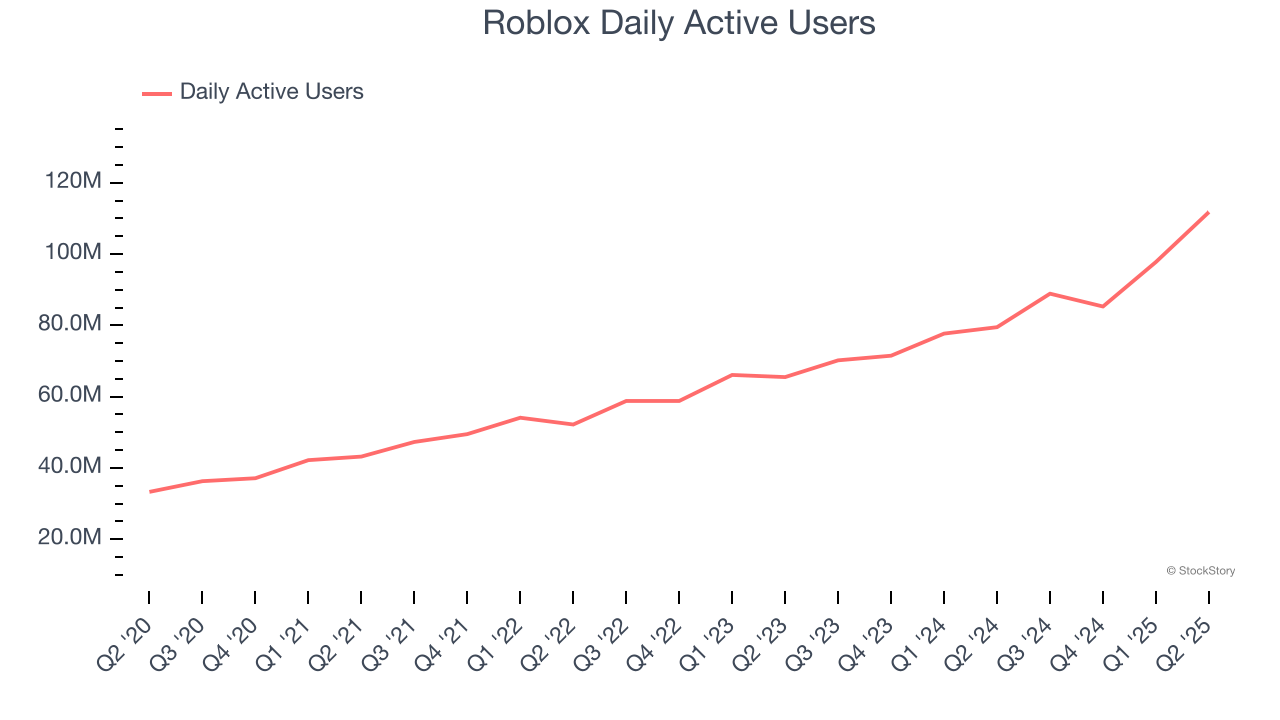

Daily Active Users

User Growth

As a video gaming company, Roblox generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Over the last two years, Roblox’s daily active users, a key performance metric for the company, increased by 24% annually to 111.8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q2, Roblox added 32.3 million daily active users, leading to 40.6% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

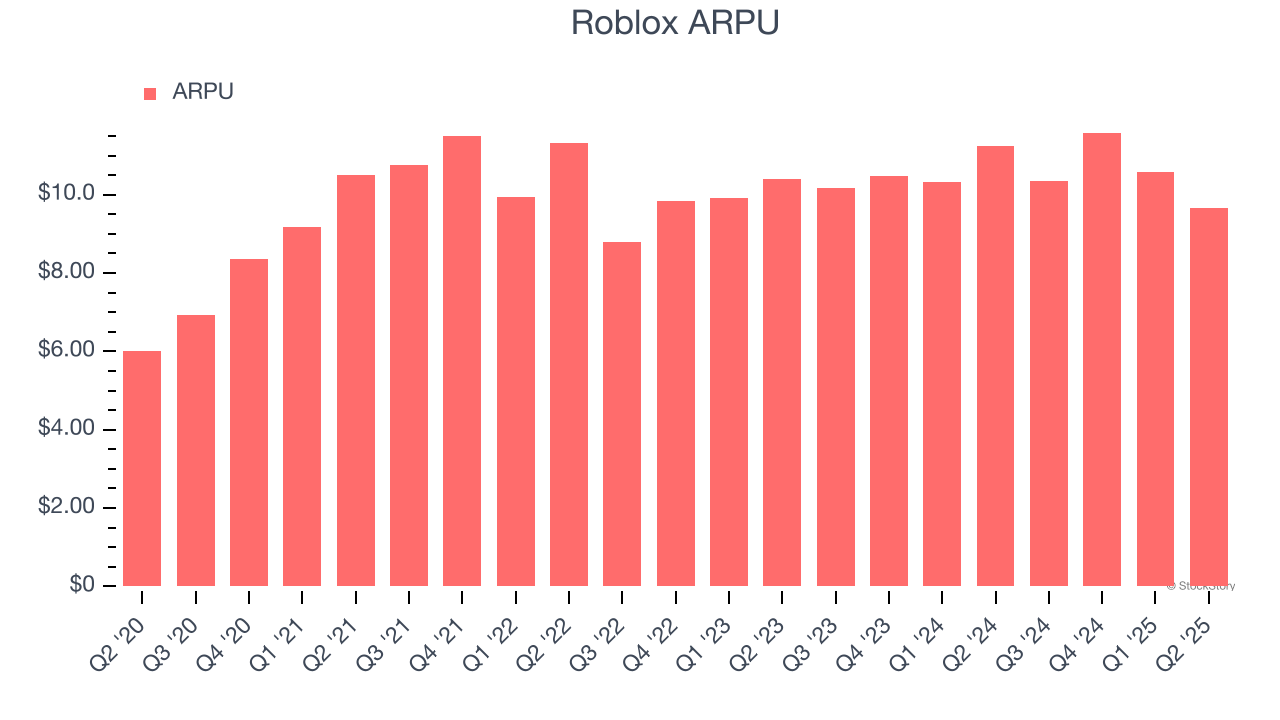

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Roblox’s ARPU growth has been mediocre over the last two years, averaging 4.4%. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roblox tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Roblox’s ARPU clocked in at $9.67. It declined 14% year on year, worse than the change in its daily active users.

Key Takeaways from Roblox’s Q2 Results

We were very impressed by Roblox’s user growth this quarter. We were also happy lifted its full-year revenue guidance. On the other hand, its full-year EBITDA guidance fell short of Wall Street’s estimates along with this quarter's revenue, EPS, and EBITDA. Overall, this was a mixed quarter. The stock traded up 17.7% to $146.99 immediately after reporting.

So should you invest in Roblox right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.