Biotechnology company Moderna (NASDAQ:MRNA) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 41.1% year on year to $142 million. On the other hand, the company’s full-year revenue guidance of $1.85 billion at the midpoint came in 10.6% below analysts’ estimates. Its GAAP loss of $2.13 per share was 29.8% above analysts’ consensus estimates.

Is now the time to buy Moderna? Find out by accessing our full research report, it’s free.

Moderna (MRNA) Q2 CY2025 Highlights:

- Revenue: $142 million vs analyst estimates of $128.3 million (41.1% year-on-year decline, 10.7% beat)

- EPS (GAAP): -$2.13 vs analyst estimates of -$3.03 (29.8% beat)

- Adjusted EBITDA: -$720 million vs analyst estimates of -$1.21 billion (-507% margin, 40.4% beat)

- The company dropped its revenue guidance for the full year to $1.85 billion at the midpoint from $2 billion, a 7.5% decrease

- Operating Margin: -639%, down from -566% in the same quarter last year

- Free Cash Flow was -$922 million compared to -$1.46 billion in the same quarter last year

- Market Capitalization: $11.43 billion

Company Overview

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ:MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Revenue Growth

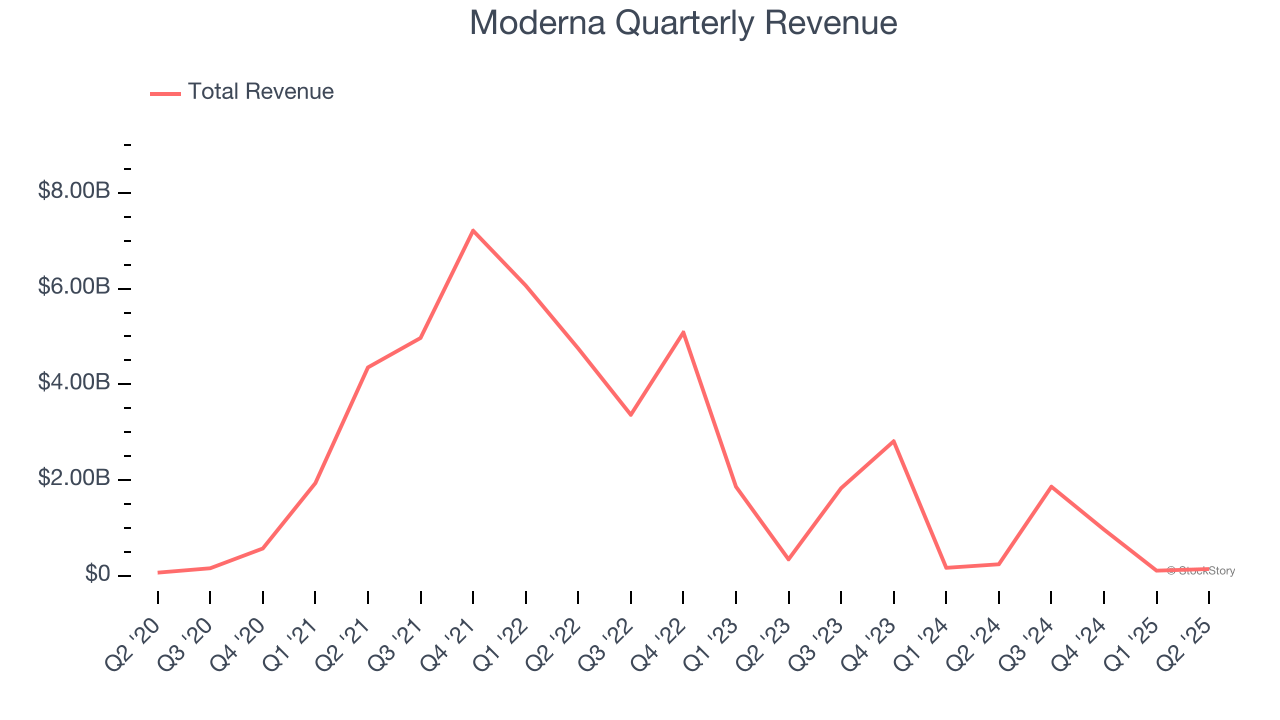

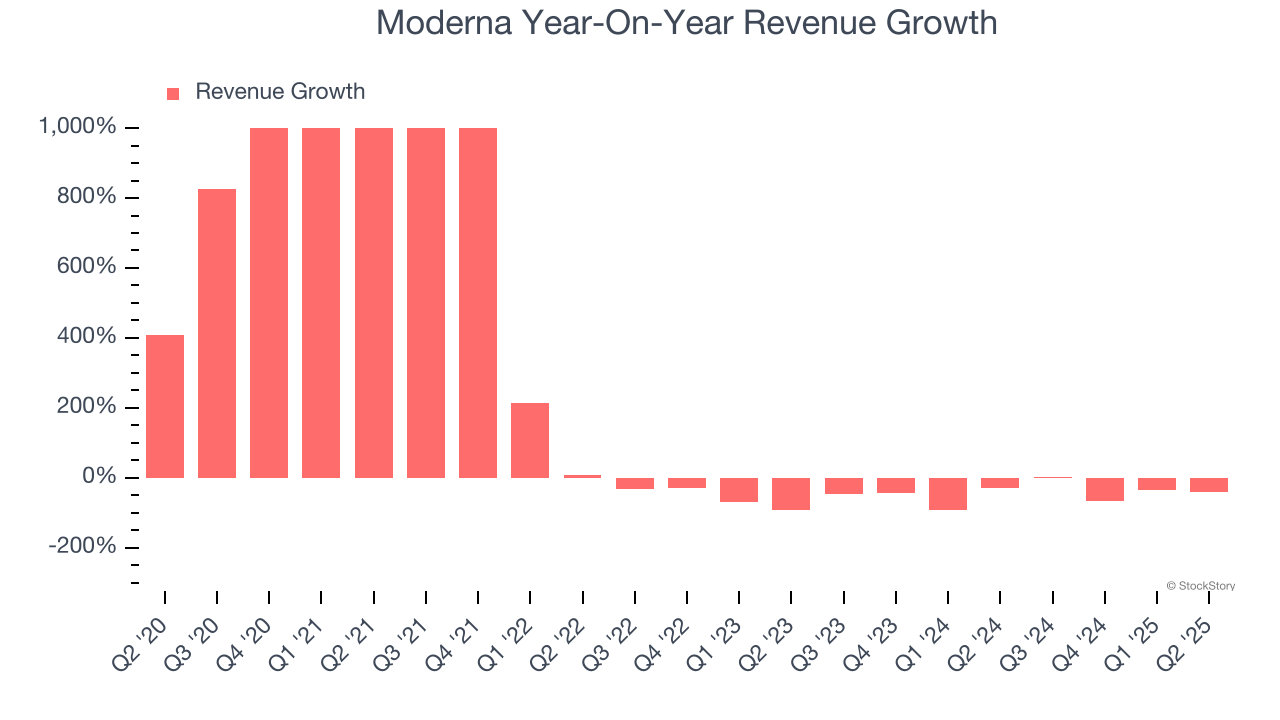

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Moderna grew its sales at an incredible 96.2% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Moderna’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 46.3% over the last two years.

This quarter, Moderna’s revenue fell by 41.1% year on year to $142 million but beat Wall Street’s estimates by 10.7%.

Looking ahead, sell-side analysts expect revenue to decline by 34.2% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

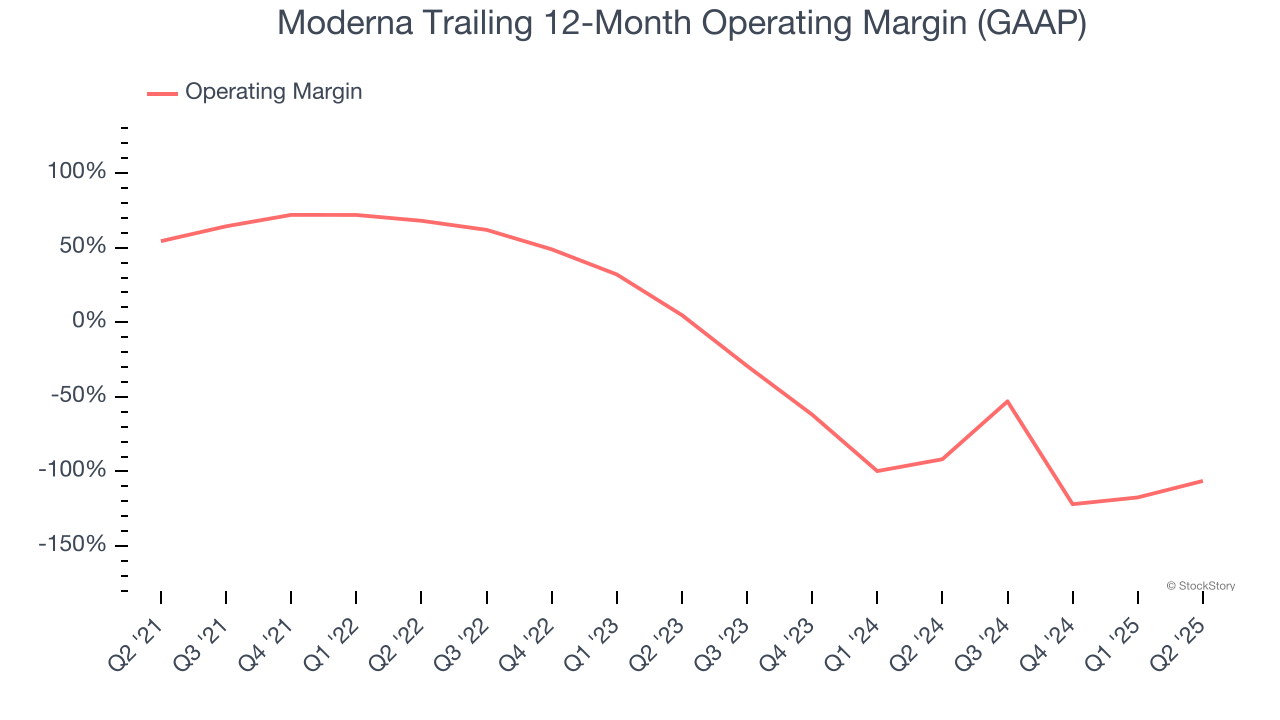

Moderna has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 24.7%.

Looking at the trend in its profitability, Moderna’s operating margin decreased significantly over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 111.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Moderna generated an operating margin profit margin of negative 639%, down 73.2 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

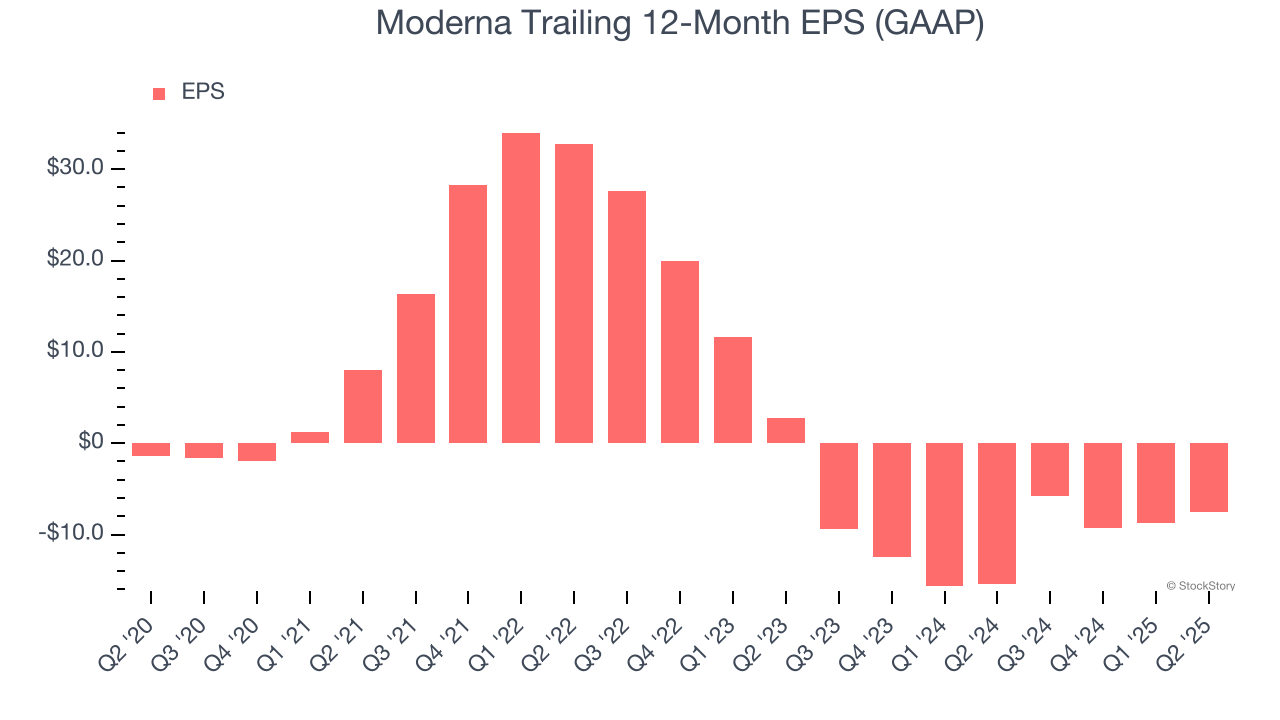

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Moderna’s earnings losses deepened over the last five years as its EPS dropped 40% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Moderna’s low margin of safety could leave its stock price susceptible to large downswings.

In Q2, Moderna reported EPS at negative $2.13, up from negative $3.33 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Moderna to perform poorly. Analysts forecast its full-year EPS of negative $7.53 will tumble to negative $10.29.

Key Takeaways from Moderna’s Q2 Results

We were impressed by how significantly Moderna blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance was lowered and missed. The poor guidance weighed on shares, and the stock traded down 5.8% to $27.84 immediately following the results.

So do we think Moderna is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.