Plant-based protein company Beyond Meat (NASDAQ:BYND) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 19.6% year on year to $74.96 million. Next quarter’s revenue guidance of $70.5 million underwhelmed, coming in 10.3% below analysts’ estimates. Its non-GAAP loss of $0.40 per share was 3.2% below analysts’ consensus estimates.

Is now the time to buy Beyond Meat? Find out by accessing our full research report, it’s free.

Beyond Meat (BYND) Q2 CY2025 Highlights:

- Revenue: $74.96 million vs analyst estimates of $82.02 million (19.6% year-on-year decline, 8.6% miss)

- Adjusted EPS: -$0.40 vs analyst expectations of -$0.39 (3.2% miss)

- Adjusted EBITDA: -$26.04 million vs analyst estimates of -$19.35 million (-34.7% margin, 34.6% miss)

- Revenue Guidance for Q3 CY2025 is $70.5 million at the midpoint, below analyst estimates of $78.63 million

- Operating Margin: -51.8%, down from -36.4% in the same quarter last year

- Free Cash Flow was -$35.15 million compared to -$17.33 million in the same quarter last year

- Sales Volumes fell 18.9% year on year (-15% in the same quarter last year)

- Market Capitalization: $237.1 million

Beyond Meat President and CEO Ethan Brown commented, “We are disappointed with our second quarter results, which primarily reflect ongoing softness in the plant-based meat category, particularly in the U.S. retail channel and certain international foodservice markets. We are responding by accelerating our transformation activities, including more rapidly and aggressively reducing our operating expenses to fit anticipated near term revenues; prioritizing increased distribution of our core product lines; and investing in margin expansion initiatives across these core products.”

Company Overview

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company specializing in alternatives to traditional meat products.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $301.4 million in revenue over the past 12 months, Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

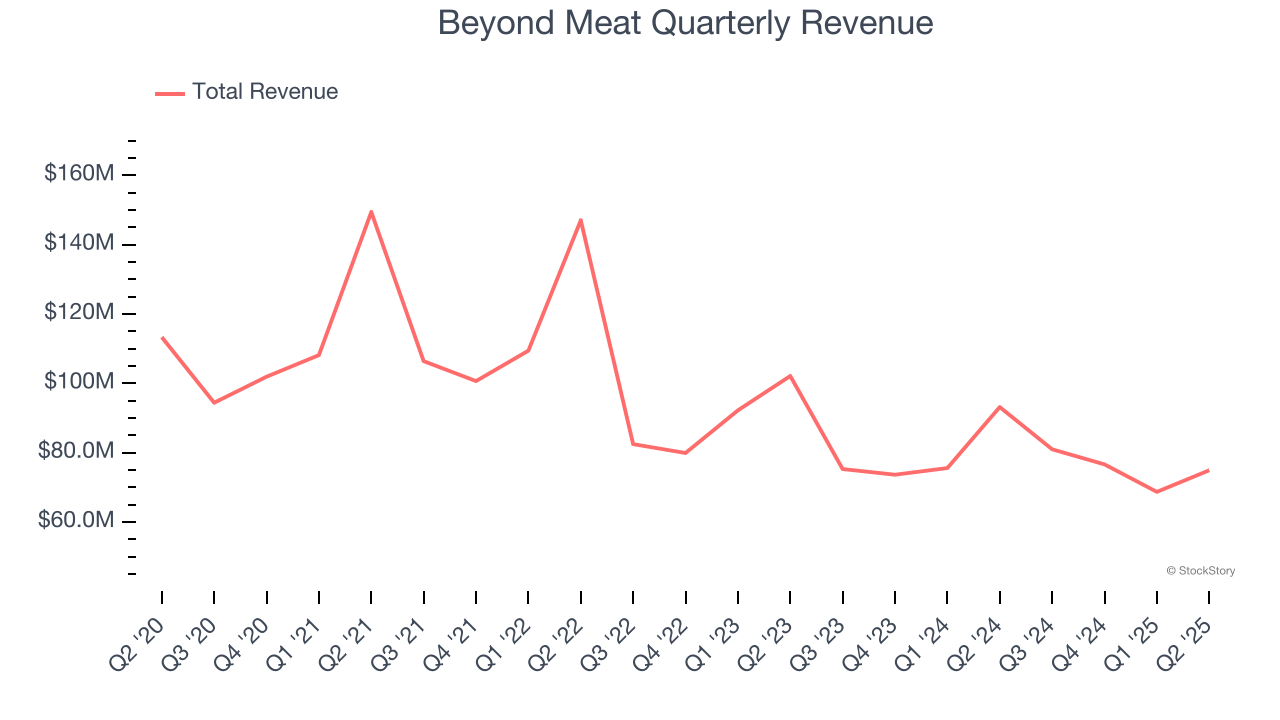

As you can see below, Beyond Meat struggled to generate demand over the last three years. Its sales dropped by 13.4% annually as consumers bought less of its products.

This quarter, Beyond Meat missed Wall Street’s estimates and reported a rather uninspiring 19.6% year-on-year revenue decline, generating $74.96 million of revenue. Company management is currently guiding for a 13% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. While this projection indicates its newer products will catalyze better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

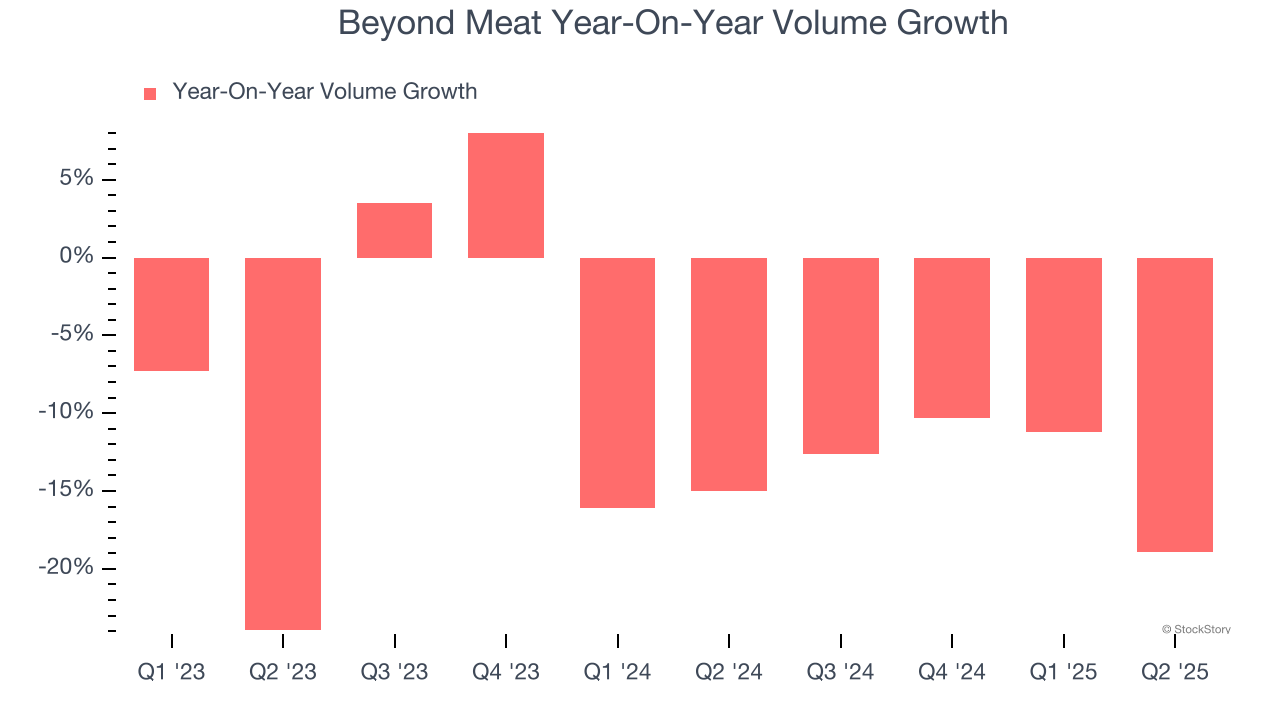

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Beyond Meat’s average quarterly sales volumes have shrunk by 9.1% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Beyond Meat’s Q2 2025, sales volumes dropped 18.9% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from Beyond Meat’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.3% to $2.80 immediately after reporting.

The latest quarter from Beyond Meat’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.