Content discovery platform Taboola (NASDAQ:TBLA) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 8.7% year on year to $465.5 million. Guidance for next quarter’s revenue was better than expected at $465 million at the midpoint, 0.6% above analysts’ estimates. Its GAAP loss of $0.01 per share was in line with analysts’ consensus estimates.

Is now the time to buy Taboola? Find out by accessing our full research report, it’s free.

Taboola (TBLA) Q2 CY2025 Highlights:

- Revenue: $465.5 million vs analyst estimates of $449.3 million (8.7% year-on-year growth, 3.6% beat)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.01 (in line)

- Adjusted EBITDA: $45.2 million vs analyst estimates of $40.99 million (9.7% margin, 10.3% beat)

- The company slightly lifted its revenue guidance for the full year to $1.87 billion at the midpoint from $1.86 billion

- EBITDA guidance for the full year is $211 million at the midpoint, above analyst estimates of $204.6 million

- Operating Margin: 0%, up from -1.8% in the same quarter last year

- Free Cash Flow Margin: 7.3%, up from 6.1% in the same quarter last year

- Market Capitalization: $1.04 billion

"We delivered a strong second quarter, beating the high end of our guidance across our key metrics,” said Adam Singolda, CEO of Taboola.

Company Overview

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola (NASDAQ:TBLA) operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.82 billion in revenue over the past 12 months, Taboola is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

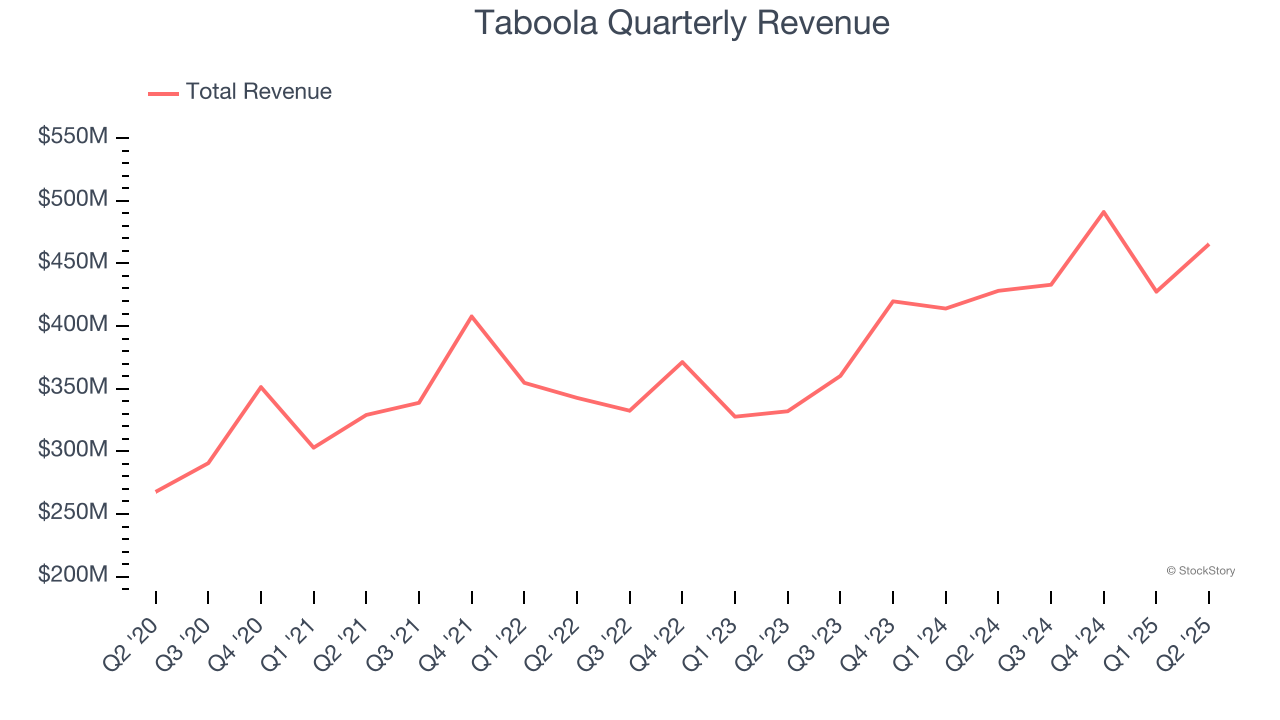

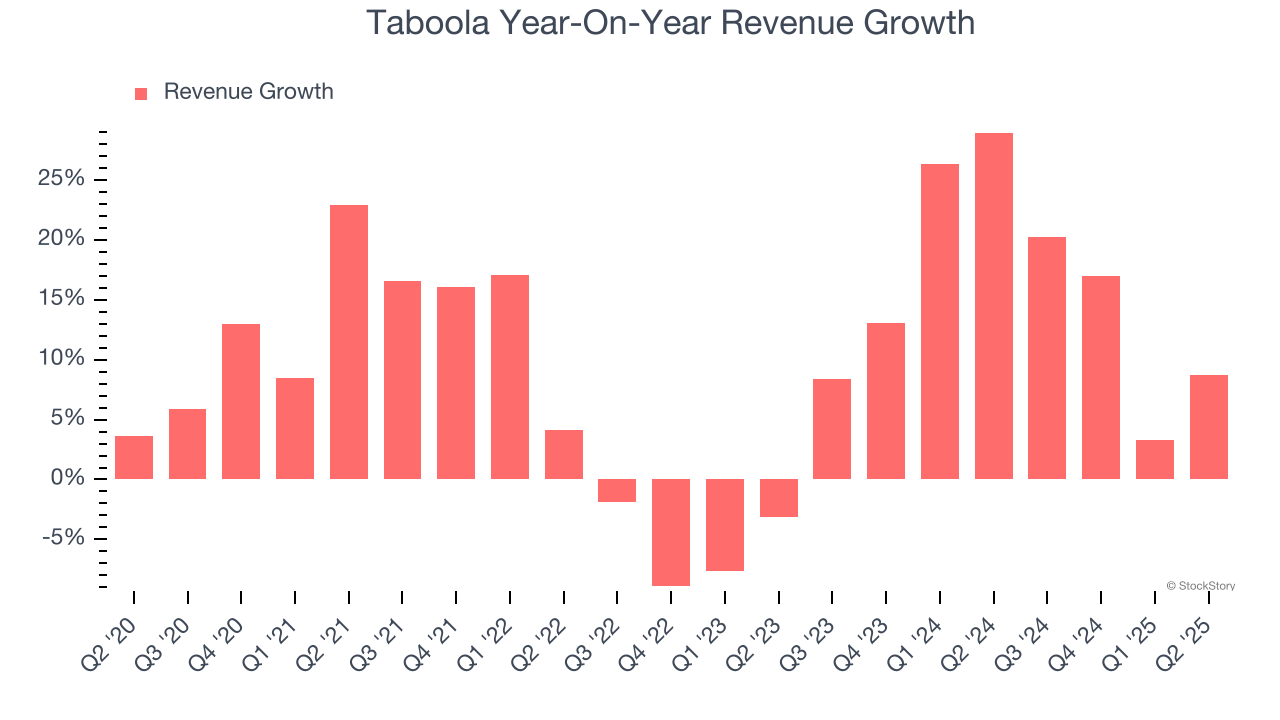

As you can see below, Taboola grew its sales at an impressive 9.9% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Taboola’s annualized revenue growth of 15.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Taboola reported year-on-year revenue growth of 8.7%, and its $465.5 million of revenue exceeded Wall Street’s estimates by 3.6%. Company management is currently guiding for a 7.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and indicates the market is forecasting some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

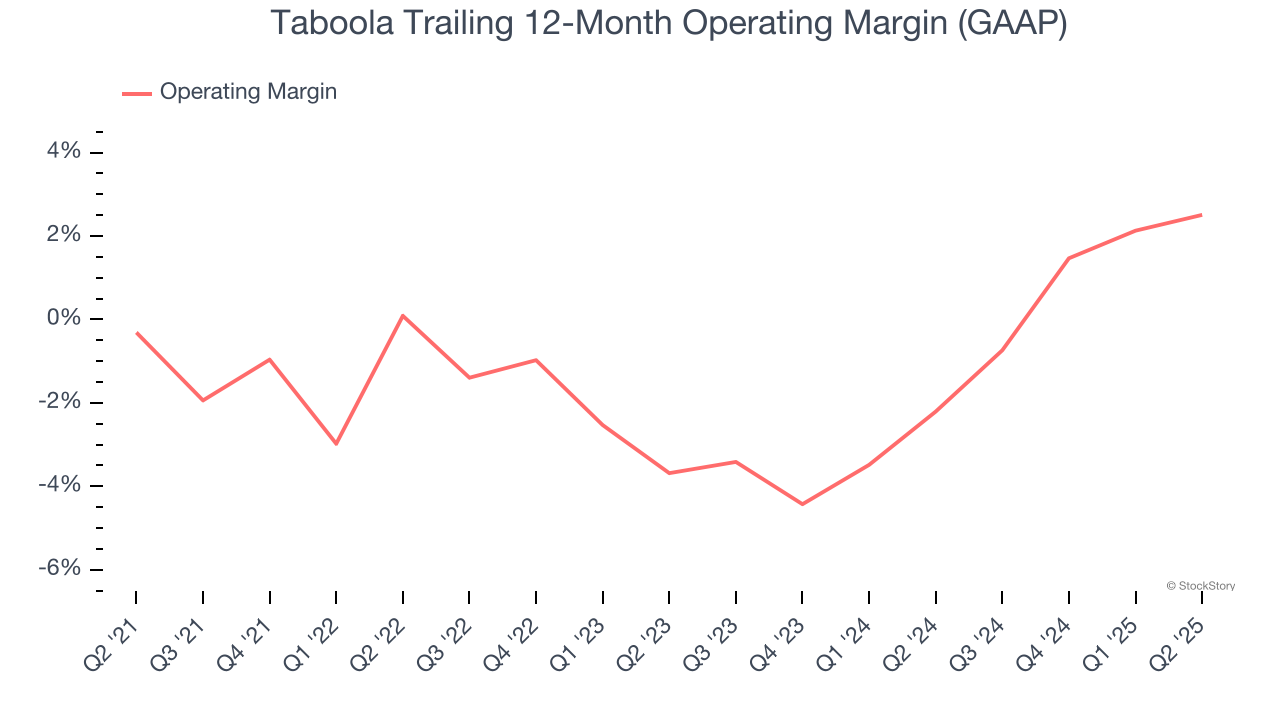

Taboola was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the business services sector.

On the plus side, Taboola’s operating margin rose by 2.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Taboola’s breakeven margin was up 1.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

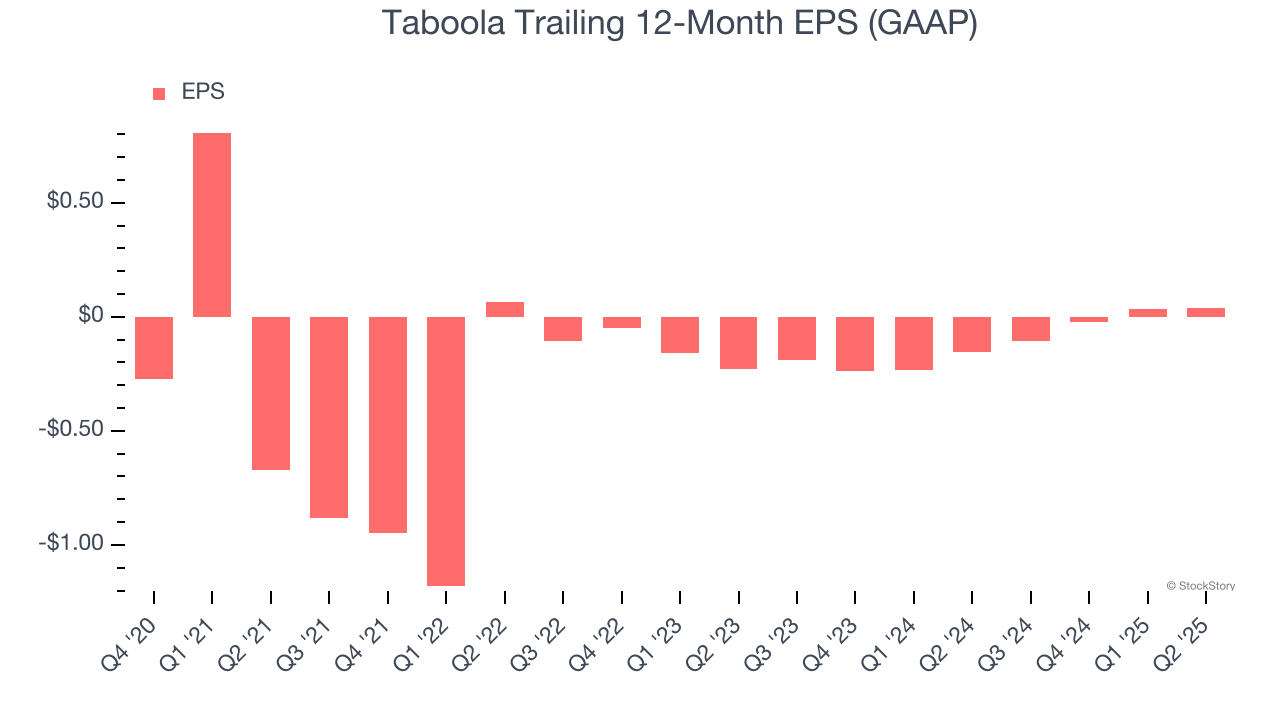

Taboola’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Taboola, its two-year annual EPS growth of 47% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Taboola reported EPS at negative $0.01, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Taboola’s Q2 Results

We enjoyed seeing Taboola beat analysts’ revenue and EBITDA expectations this quarter. We were also glad its revenue and EBITDA guidance for next quarter slightly exceeded Wall Street’s estimates. Overall, this was a very good quarter. The stock traded up 11.7% to $3.58 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.