Egg and butter company Vital Farms (NASDAQ:VITL) announced better-than-expected revenue in Q2 CY2025, with sales up 25.4% year on year to $184.8 million. The company’s full-year revenue guidance of $770 million at the midpoint came in 3.3% above analysts’ estimates. Its GAAP profit of $0.36 per share was 29.6% above analysts’ consensus estimates.

Is now the time to buy Vital Farms? Find out by accessing our full research report, it’s free.

Vital Farms (VITL) Q2 CY2025 Highlights:

- Revenue: $184.8 million vs analyst estimates of $171 million (25.4% year-on-year growth, 8% beat)

- EPS (GAAP): $0.36 vs analyst estimates of $0.28 (29.6% beat)

- Adjusted EBITDA: $29.92 million vs analyst estimates of $22.85 million (16.2% margin, 30.9% beat)

- The company lifted its revenue guidance for the full year to $770 million at the midpoint from $740 million, a 4.1% increase

- EBITDA guidance for the full year is $110 million at the midpoint, above analyst estimates of $102.4 million

- Operating Margin: 12.9%, up from 11.6% in the same quarter last year

- Free Cash Flow was -$7.63 million, down from $10.54 million in the same quarter last year

- Market Capitalization: $1.66 billion

"We delivered second quarter results that exceeded our initial expectations, demonstrating the overall strength of our business model and expanding year-over-year consumer awareness of our strong brand," said Russell Diez-Canseco, Vital Farms' President and Chief Executive Officer.

Company Overview

With an emphasis on ethically produced products, Vital Farms (NASDAQ:VITL) specializes in pasture-raised eggs and butter.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $657.9 million in revenue over the past 12 months, Vital Farms is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

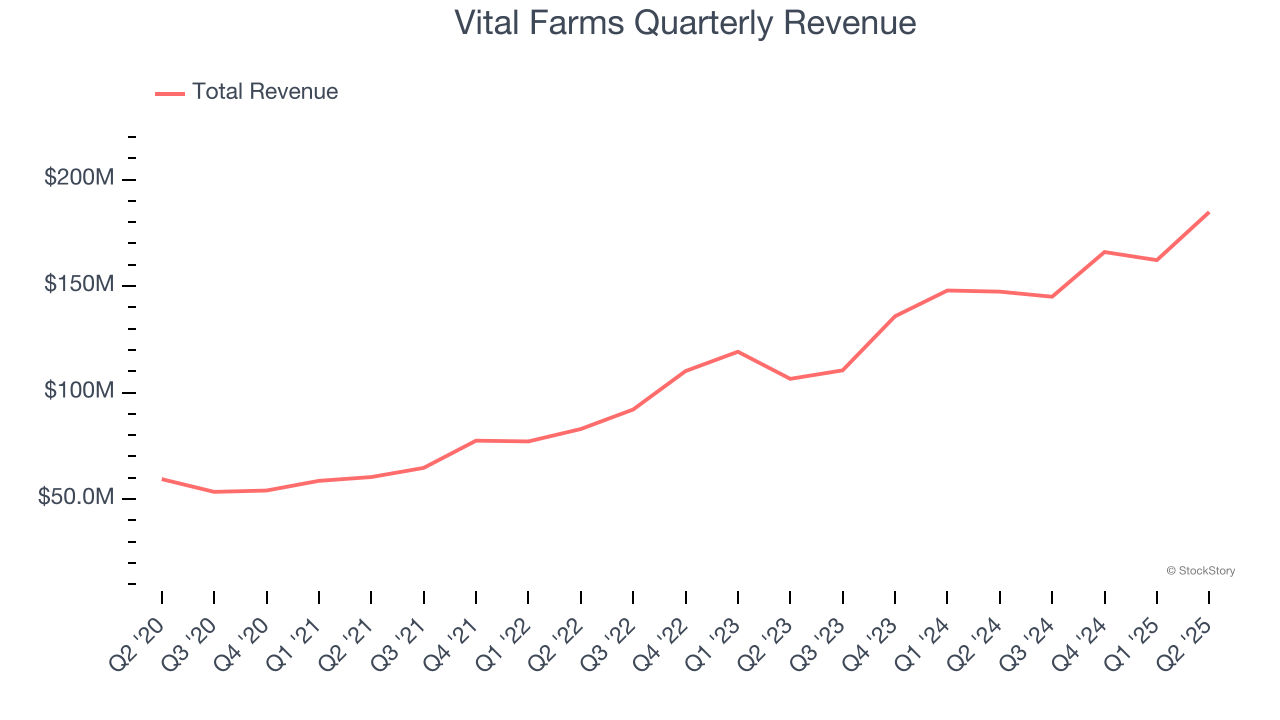

As you can see below, Vital Farms’s 29.6% annualized revenue growth over the last three years was exceptional as consumers bought more of its products.

This quarter, Vital Farms reported robust year-on-year revenue growth of 25.4%, and its $184.8 million of revenue topped Wall Street estimates by 8%.

Looking ahead, sell-side analysts expect revenue to grow 24.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and indicates the market is baking in success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

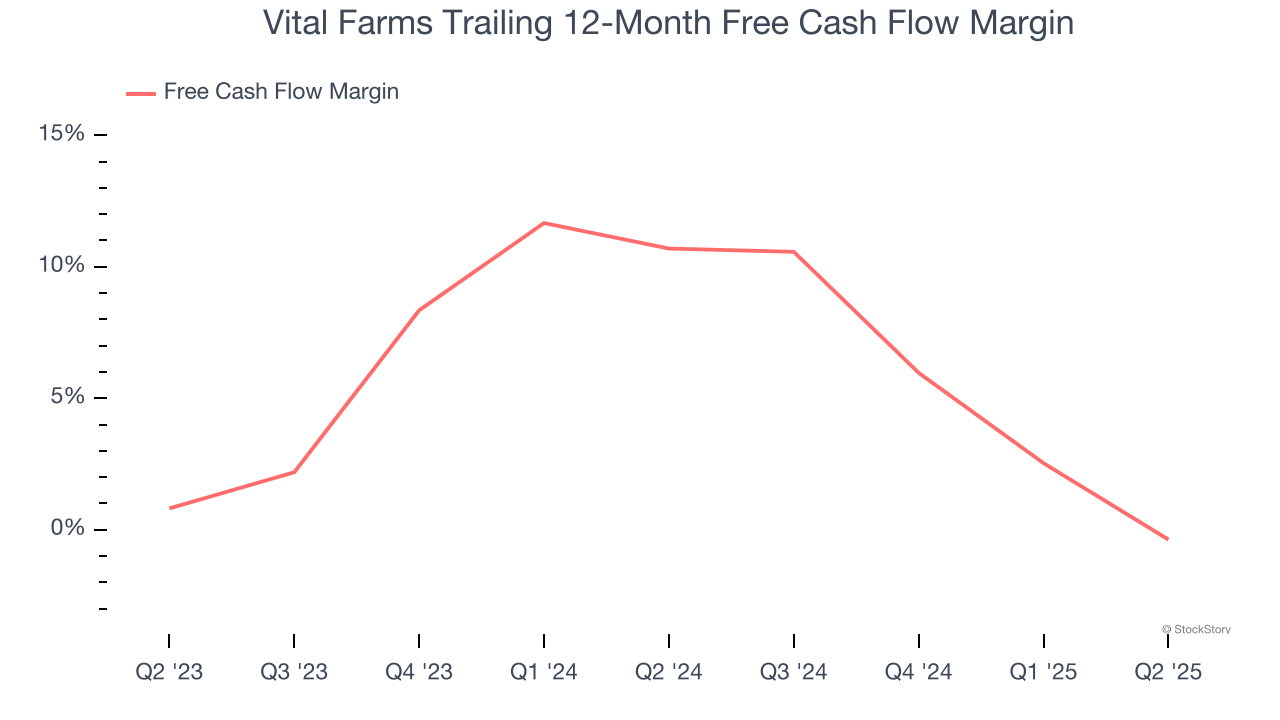

Vital Farms has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.6%, subpar for a consumer staples business.

Taking a step back, we can see that Vital Farms’s margin dropped by 11.1 percentage points over the last year. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Vital Farms burned through $7.63 million of cash in Q2, equivalent to a negative 4.1% margin. The company’s cash flow turned negative after being positive in the same quarter last year, which isn’t ideal considering its longer-term trend.

Key Takeaways from Vital Farms’s Q2 Results

We were impressed by how significantly Vital Farms blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 16.3% to $43.39 immediately after reporting.

Indeed, Vital Farms had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.