Goldman Sachs Group (GS)

944.69

+9.28 (0.99%)

NYSE · Last Trade: Feb 2nd, 12:59 PM EST

Lazard Inc (NYSE: LAZ) reported a blowout fourth-quarter for 2025, significantly exceeding analyst expectations as a resurgence in global deal-making and a robust expansion in its investment management business bolstered the firm’s bottom line. The financial powerhouse reported an adjusted earnings per share (EPS) of $0.80 for the

Via MarketMinute · February 2, 2026

The financial landscape shifted on January 30, 2026, when President Donald Trump officially nominated Kevin Warsh to succeed Jerome Powell as the next Chairman of the Federal Reserve. The announcement, coming just months before Powell’s term expires on May 15, 2026, has sent a series of shockwaves through global

Via MarketMinute · February 2, 2026

Shares of Sandisk Corp. continued their upward momentum on Monday, gaining over 16% after the company posted strong quarterly results last week.

Via Stocktwits · February 2, 2026

As the sun rises on February 2, 2026, the global financial community is bracing for what is arguably the most consequential data point of the new year: the January Nonfarm Payrolls (NFP) report. With a consensus estimate currently hovering at a modest 68,000 job gains, the upcoming data release

Via MarketMinute · February 2, 2026

From new regulation to new advances in AI, here's what's coming for prediction markets over the next 12 months.

Via The Motley Fool · February 2, 2026

In a resounding victory for the "efficiency-first" corporate mandate of 2025, the U.S. Bureau of Labor Statistics reported this morning that nonfarm business sector productivity surged by a staggering 4.9% in the fourth quarter of 2025. This unexpected jump represents the strongest quarterly performance in over two years,

Via MarketMinute · February 2, 2026

SoFi Technologies (NASDAQ: SOFI) has officially entered a new echelon of the financial services industry, reporting a historic fourth quarter for 2025 that saw the digital lender surpass $1 billion in quarterly revenue for the first time. The results, released on January 30, 2026, showcased a powerhouse performance across its

Via MarketMinute · February 2, 2026

Oracle Corporation (NYSE: ORCL) has sent shockwaves through the financial and technology sectors by announcing a massive $50 billion capital-raising plan for the 2026 calendar year. This unprecedented move marks a definitive pivot for the enterprise software giant as it aggressively builds out the physical infrastructure required to power the

Via MarketMinute · February 2, 2026

The global gold market witnessed a historic decoupling this week as a sudden, violent liquidation by financial institutions shattered months of record-breaking momentum. On January 30, 2026, the perceived safety of the "debasement trade" evaporated in a matter of hours, sending the SPDR Gold Shares (NYSE: GLD) into a tailspin,

Via MarketMinute · February 2, 2026

On January 30, 2026, the financial world experienced a "regime shift" that few saw coming with such velocity. The nomination of Kevin Warsh as the next Chairman of the Federal Reserve by the White House effectively lanced the speculative bubble that had propelled precious metals to dizzying heights throughout 2025.

Via MarketMinute · February 2, 2026

The global financial landscape was rocked on Friday, January 30, 2026, by a violent "flash crash" in the precious metals markets, wiping out trillions in paper wealth in a matter of hours. Gold, the perennial safe-haven asset, plummeted a staggering 9.5% to settle at $4,861 per ounce, while

Via MarketMinute · February 2, 2026

Both businesses are ideally suited to support reliable dividend payments.

Via The Motley Fool · February 2, 2026

Caution is warranted, but investors can still find great opportunities.

Via The Motley Fool · February 2, 2026

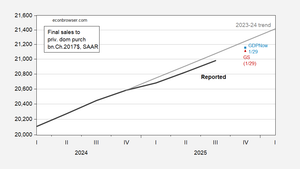

From Atlanta Fed and Goldman Sachs, numbers that perhaps better represent the trajectory of aggregate demand.

Via Talk Markets · February 2, 2026

He stated that U.S. liquidity had also been constrained by the two government shutdowns and by inflows into the U.S. Treasury, which had nowhere to go.

Via Stocktwits · February 2, 2026

Contrary to a common assumption, not all utility stocks are the same.

Via The Motley Fool · February 1, 2026

The cloud firm has faced scrutiny over its debt-fueled buildout of AI infrastructure, which has pressured its shares in recent months.

Via Stocktwits · February 1, 2026

The prediction market landscape has officially entered its most volatile and high-stakes era yet. Following a staggering 2025 that saw over $40 billion in total trading volume, the industry is now locked in what analysts are calling the "Great Prediction War." This isn't just a race for market share; it is a fundamental clash between [...]

Via PredictStreet · February 1, 2026

Accelerating investment in AI infrastructure will remain a strong tailwind for chip stocks -- and not just the GPU specialists.

Via The Motley Fool · January 31, 2026

Industry research forecasts that AI hyperscalers will spend at least $500 billion on infrastructure in 2026.

Via The Motley Fool · January 31, 2026

In a year marked by a significant "lower for longer" pricing environment and shifting global energy dynamics, Chevron Corporation (NYSE: CVX) reported a resilient fourth-quarter 2025 performance that exceeded analyst expectations on the bottom line. Despite facing a sharp decline in average Brent crude prices—averaging $69 per barrel in

Via MarketMinute · January 30, 2026

The financial markets were jolted on January 30, 2026, as the Bureau of Labor Statistics (BLS) released Producer Price Index (PPI) data for December 2025 that was significantly "warmer" than any analyst had predicted. Headline PPI rose 0.5% month-over-month, more than double the consensus estimate of 0.2%, while

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

The company reported revenue of $3.02 billion for the quarter, 25% higher compared to the same period last year, and above analyst estimates of $2.9 billion.

Via Stocktwits · January 30, 2026

Goldman Sachs gave the salad stock a thumbs-down.

Via The Motley Fool · January 30, 2026