Global X MLP ETF (MLPA)

53.19

+0.00 (0.00%)

NYSE · Last Trade: Feb 20th, 9:32 AM EST

Detailed Quote

| Previous Close | 53.19 |

|---|---|

| Open | - |

| Day's Range | N/A - N/A |

| 52 Week Range | 45.09 - 54.17 |

| Volume | 253 |

| Market Cap | 19.07M |

| Dividend & Yield | 3.920 (7.37%) |

| 1 Month Average Volume | 265,327 |

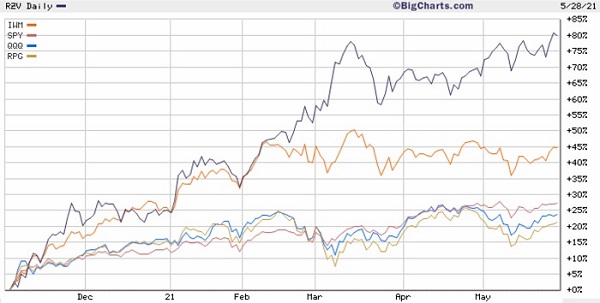

Chart

News & Press Releases

This ETF offers a hefty dividend and the prospect of relatively safe income for decades to come.

Via The Motley Fool · October 2, 2025

Investing in dividend-paying ETFs can be a great way to achieve diversification and generate passive income no matter what the broader market is doing.

Via The Motley Fool · July 29, 2025

Via The Motley Fool · March 31, 2025

Oil prices fell 1% due to geopolitical change and economic uncertainty. Diplomatic talks and sanctions relief could impact Russian oil output.

Via Benzinga · March 19, 2025

The March MLP Monthly Report can be found here offering insights on MLP industry news, the asset class’s performance, yields, valuations, and fundamental drivers.

Via Talk Markets · March 13, 2022

Here is a brief look at the February MLP Monthly Report, which offers insights on MLP industry news, the asset class’s performance, yields, valuations, and fundamental drivers.

Via Talk Markets · February 12, 2022

Via The Motley Fool · February 5, 2025

Via The Motley Fool · December 24, 2024

A high-yielding gas energy pipeline ETF and two oil companies gushing cash make up a list of three great stocks to buy for future dividends.

Via The Motley Fool · November 16, 2024

These two dividend stocks and an ETF are packed with way more passive income potential than the S&P 500.

Via The Motley Fool · November 7, 2024

Two ETFs and a leading package delivery company offer income-seeking investors excellent options.

Via The Motley Fool · November 3, 2024

ONEOK to acquire GIP's stake in EnLink Midstream for $3.0 billion, also purchasing Medallion Midstream for $2.6 billion.

Via Benzinga · August 29, 2024

Sunoco LP reported Q2 FY24 revenues of $6.17B, beating consensus of $5.82B. Adjusted distributable cash flow and EBITDA increased YoY, and EPS surpassed consensus. The company reaffirmed FY24 guidance and raised NuStar synergies.

Via Benzinga · August 7, 2024

Stifel analyst upgrades Sunoco LP to Buy and maintains price target of $62.00. Believes upcoming guidance could boost unit price, estimates EBITDA of $1.48B in FY24 and $1.79B in FY25.

Via Benzinga · June 7, 2024

Sunoco LP reported first-quarter FY24 results with revenues of $5.50B, exceeding consensus. Partnership increased distribution by 4% and revised FY24 guidance for adjusted EBITDA.

Via Benzinga · May 8, 2024

Pipeline operators Enterprise Product Partners, Energy Transfer, and MPLX are outperforming the broader market while also throwing off high dividend yields.

Via MarketBeat · February 17, 2023

With energy supply uncertainty, the role of the midstream segment and the US shale industry is now firmly on investors’ radars. Rising rates also present midstream equities as an option, given their higher yields compared to other asset classes.

Via Talk Markets · April 23, 2022

This year's stock market predictions emphasize being selective about choosing stocks. These seven cross-sector ideas could help investors generate lucrative returns in 2022.

Via InvestorPlace · January 12, 2022

For long-term investors, the recent decline in oil and energy stocks provides an attractive entry point for these seven top stocks.

Via InvestorPlace · December 2, 2021

Stocks are once again challenging all-time highs as the forward earnings estimates are being raised at a historically high rate in the wake of another impressive earnings season that blew away all consensus expectations.

Via Talk Markets · June 3, 2021

Interest rates have been rising, but they are still low from a historical viewpoint. Investors seeking income haven’t had many options.

...

Via Benzinga · May 28, 2021